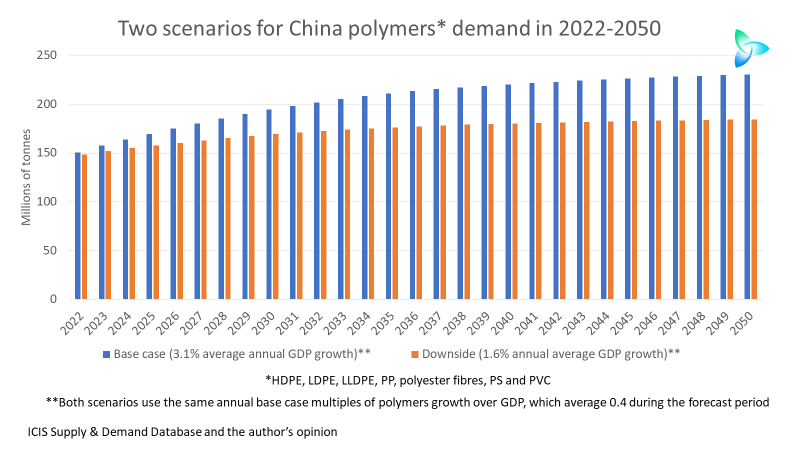

Cumulative downside demand in the above chart would total 5bn – 91m tonnes lower than our base case.

Asian Chemical Connections

China’s post-lockdown economic rebound has yet to happen, according to the ICIS spreads data

At some point, polyolefins exporters to China and the local producers will regain pricing power. This will become apparent from a widening of spreads as economic activity returns to normal. It really is as simple as this. So, you need our data and analysis.

China’s ethylene equivalent demand growth in 2022 could be as high as plus 9% or as low as minus 3%

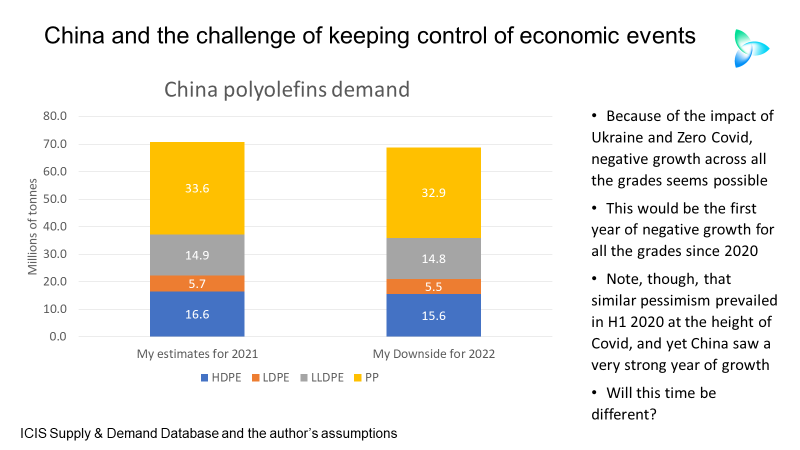

Scenario 1, the ICIS Base Case, for China’s ethylene equivalent demand, sees growth at 9% in 2022 over last year. Scenario 2 involves 4.5% and Scenario 3, minus 3%.

PE and PP production decisions become super-critical amid Ukraine-Russia, zero-COVID complications

Every tonne you don’t produce, when you correctly assess that the demand isn’t there in a particular market, will be important in preserving cashflow. Cashflow could once again be king, as it was just during the 2008-2009 Global Financial Crisis; and every tonne that you do produce, when you accurately assess that demand is there will, of course, support your revenues.

Global chemicals face negative growth on inflation, more logistics problems and a deep China downturn

SUPPLY-CHAIN problems continue to disrupt the global chemicals and polymer industries more than two years since the pandemic began.

Right now, the centre of attention of supply-chain anxiety is China.

China polyolefins: several years of history pass in just one week

LAST WEEK I challenged whether the longstanding “put option” for petrochemicals companies and investors would still apply to China 2022.

The put option rests on the well-proven notion that the worst things get in the short term, the better the immediate outlook because Beijing always rides to the rescue with big economic stimulus.

The challenge I posed to the put option was that China might only tinker around the edges of its Common Prosperity economic reforms.

China’s HDPE market in 2022 will be a litmus test of how well Beijing can manage unprecedented challenges

By John Richardson CHINA’S INCREASING self-sufficiency in high-density polyethylene (HDPE), combined with the potential for slower economic growth, is a developing story which is obviously being overshadowed by Ukraine. But China’s decisions on operating rates – as much political as economic –- and on whether its sticks hard and fast to Common Prosperity reforms in […]

Ukraine: Oil prices, lost petrochemicals demand, changing trade flows and the impact of the four megatrends

By John Richardson IF WE ARE involved in a new protracted Cold War, this will change just about everything for the petrochemicals industry. Or, of course, we could go back to the Old Normal. Corporate planners must therefore press on with drawing up short, medium and long-term scenarios and then apply these scenarios to tactics […]

China LDPE: Final review for 2021 and outlook for the rest of this year

Today I complete my series of posts on China’s polyolefins markets in 2021 with outlooks for 2022. This post focuses on low-density polyethylene (LDPE), following my earlier posts on polypropylene (PP), high-density PE (HDPE) and linear low-density PE (LLDPE). By John Richardson DO YOU want the good news or the bad news first? This is […]

China’s LLDPE market: final review for 2021 and further outlook for this year

China’s LLDPE demand grew by just 1% last year, below market expectations, with further 2022 downward pressure likely on Common Prosperity and Zero COVID