The packaging supply chain needs to come to grips with inflation, but in a context few are considering at the moment – the sustainability movement.

It was accepted before the pandemic that as brand owners’ pledges towards sustainability and a circular economy drew nearer to the oft-targeted 2025 timeframe, limited availability of materials of much-desired transparent post-consumer recycled material (PCR) would put prices for such material at a premium to virgin offerings of polyethylene terephthalate (PET), polyethylene (PE) and polypropylene (PP). ICIS data such as that in the differential chart below for the most mature of global recycling markets, Europe, bears that out. It is a trend that has held true through the pandemic despite snug supply conditions in some markets such as virgin PET that have taken its prices to lofty levels.

The same trend has shown up in the North American and Asian markets regarding transparent PCR, which typically contains the lowest level of contaminants and has the best visual display properties, making it the grade of choice across R-PET, R-PE and R-PP when looking to source recycled material for packaging purposes.

Again, that was the given even without a pandemic befalling the world. What was not expected was come 2022 to be mired in the worst inflationary environment for some regions in decades – for the US, four decades to be exact, as the current year-on-year inflation rate of 7.5% is the worst since February 1982.

Escalating prices for recycled plastics were expected. Escalating prices for everything else was not, and that poses new challenges for those who transact in the plastic supply chain and those tasked with steering their companies’ plastics circularity objectives.

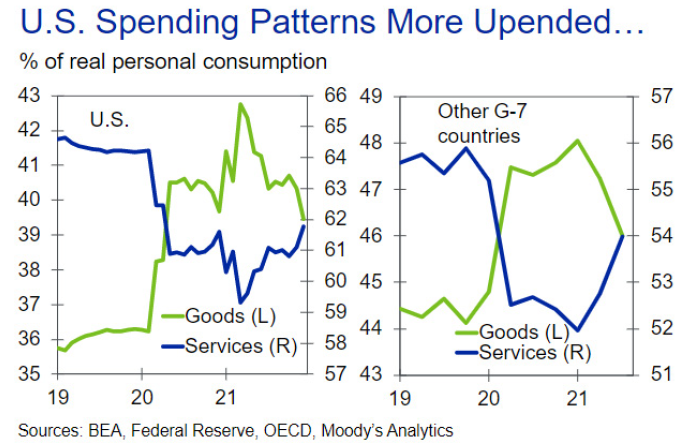

In the near term, inflation is more a growing concern than a growing impediment. Consumer demand remains robust despite elevated prices as Walmart’s C-suite discussed recently following the retailers’ outstanding Q4 2021 results. Moody’s Analytics illustrated how resilient that demand has been via a couple of great charts. The first shows how real personal consumption flipped from service-dominated to goods-dominated at the beginning of the pandemic and only now is starting its trek back to pre-coronavirus norms.

The second chart shows how consumption since mid-2020 has outpaced its previous growth trajectory, and how impending interest rate hikes from the US Federal Reserve to curb inflation is forecasted by Moody’s to curtail that surge in the years ahead but still keep it ahead of trend until 2027.

But, as the saying goes, the cure for high prices is high prices, and eventually consumers run out of extra money, the willingness to pay high prices or both. Many experts see economic headwinds gathering towards the 2023 or later timeframe that could put an end to juiced consumer demand and possibly even pull the US into recession – and to lean on another age-old saying, when the US economy sneezes, the world can catch a cold.

So what does this have to do with sustainability and recycling markets? Does that mean that demand for recycled materials will fall with a downturn in consumer demand growth? No, and that is the challenge. Let us map this out:

- A return to pre-COVID-19 consumer demand patterns or a significant economic downturn would reverberate up the supply chain, leading to lower demand for raw materials such as virgin PE, PET and PP.

- Prices for virgin resins and production of goods made with them fall as a result amid battles by resin manufacturers and converters to retain market share.

- Prices for recycled materials, particularly transparent PCR material plastics, do not follow suit and rise above current levels, as while demand for virgin plastic for packaging sees its growth slowed, tight supply and heavy demand for PCR materials elevate their value above what historically would have been the case before sustainability became a focal point of goods production. In fact, lower demand growth for virgin plastics translates to lower recycled feedstock growth for PCR, thus creating upstream pricing pressure.

- Deteriorating economic conditions lead to governments deprioritising funding and projects regarding waste management, which in turn negatively affects collection volumes and quality of what is recovered, thereby adding to feedstock supply pressures for PCR.

- Retail prices for consumer goods incorporating transparent PCR material continue to face inflationary pressures from their plastics spend when similar raw materials cost increasingly less.

With so many brand owners’ posting aggressive sustainability targets, the market for transparent PCR material is not inflation sensitive because it has not established a threshold where supply outstrips demand due to high prices. At present, there is always a brand owner or converter willing to pay, as sustainability targets trump everything.

ICIS data shows why. According to the ICIS Mechanical Recycling Supply Tracker, total current global output of transparent PCR R-PET, R-PE and R-PP is just 2.7m tonnes/year. That is a mere 1.3% of 2022’s expected 205m tonnes of global production of PET, PE and PP when combining virgin and recycled outputs, according to the ICIS Supply & Demand Database. Every bit of that transparent PCR material is needed to attempt to meet sustainability goals from brand owners in the food, beverage and personal-care space, and it simply is not enough.

The stress this could put on those affected by transparent PCR material price escalation in a time of economic unease should not be underestimated. Will that lead to backsliding on sustainability commitments in the near term? Possibly, but that will not alter sustainability efforts in general. The need to obtain recycled material for packaging will remain because even if a company cannot meet its targets, it must show that it is trying or else face a backlash from consumers in the form of turning to competing brands it deems more aligned with its circularity values.

If economic conditions deteriorate in the near future, sustainability managers would be tasked with explaining why costs to meet circularity goals keep rising in an environment where replacement virgin materials are markedly cheaper and could help the company maintain or grow profits that shareholders expect. Procurement managers would face similar questions but be burdened more directly with the challenge of securing supply of expensive transparent PCR material. And while high prices would spur additional investment into gathering and processing of transparent PCR material, such production could not start up overnight, and the magnitude needed to make significant strides towards supply-demand balance for food-grade R-PET seems quite a ways off.

History shows, though, that such challenging conditions spark innovation and new solutions, and this scenario would surely be no different. How those take form will be something to watch and likely will come from some mix of expanded mechanical recycling capacity, brand owner takeback programmes where brand owners work directly with customers to recycle their own products, deployment of commercial-scale chemical recycling, and more.

Whether accelerating demand and pricing for transparent PCR material occurs in good or challenging macroeconomic conditions remains to be seen but increasing concerns about a recessionary environment come 2023 or soon after should be heeded. Undertaking scenario planning and strengthening vital supply chain relationships in the present can gird the plastics supply chain for the possible stormy economic conditions ahead.

Disclaimer: The views in this blogpost should in no shape or form be taken as actual forecasts and are my personal views only.