The 2022 American Fuel & Petrochemical Manufacturers (AFPM) International Petrochemical Conference (IPC) opened amid myriad uncertainties few envisioned even a year ago.

Sure, many figured the recovery from the COVID-19 pandemic would be ongoing, but the prevailing thought was that the supply chain disruptions it wrought alongside severe weather events such as February 2021’s Winter Storm Uri on the US Gulf Coast would be well on their way to resolution. War was not on any industry radars, and any mention of the possibility of $200/bbl crude oil might have gotten you laughed out of a cocktail party. Expectations were that the road to securing supply would be a clearer path, and that sustainability ambitions would further gain prominence.

Industry groupthink at least got the latter right.

The pandemic continues to roil supply chains with uneven pockets of demand and logistics backups, and supply has been affected by various planned and unplanned production outages. The Russia-Ukraine conflict has amplified those issues, and some experts believe it has added momentum that began with the pandemic to a move away from globalisation and towards regionalisation of supply chains. BlackRock CEO Larry Fink even went so far as to call the war the lynchpin in ending globalisation as we have known it since the Cold War ended late last century. Meanwhile, the alteration of global oil trade flows has crude headed higher, with some top traders now saying $200/bbl or higher is not out of the question.

Some of the above pronouncements feel like hyperbole, while other elements lack context and detailing of ramifications of those developments. For example, if crude oil hits $200/bbl, it does not do it in a vacuum or on its own – it drags fuel and chemical prices higher along with it and causes a great deal of fallout that can determine just how sustainable such a price move by crude oil would be. The ICIS base-case forecast is for Brent crude oil, the global benchmark, to hit $120/bbl this summer on strong seasonal demand and supply tightness due to the world shunning Russian oil, but no one should be surprised if crude ends up going higher.

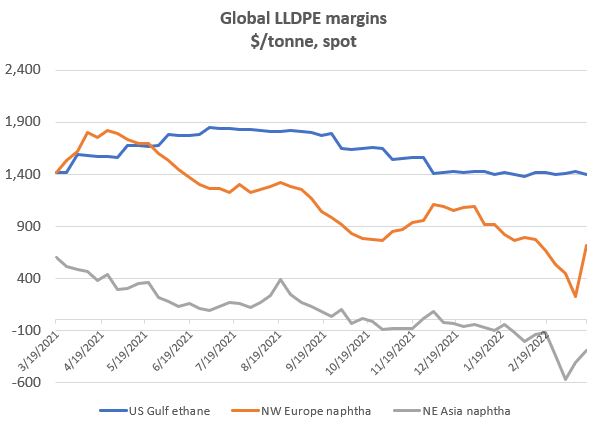

IPC conversations in recent years past were coloured by a US shale-led deflation of crude oil values and some worries that the shale-gas advantage on which the petrochemical industry invested billions of dollars in the past decade in the US would increasingly see that advantage erode with crude prices. Talk now is of the cushion shale gas gives US ethylene-derivative production in a world still mostly dominated by naphtha feedstock derived from crude oil.

Chart 1: The US ethylene advantage, as illustrated by linear low-density polyethylene (LLDPE) margins for the three major production regions.

Huge opportunities are at hand for US producers of ethylene and its derivatives, especially in a world where security of supply remains tenuous in many places. Bringing secure, advantaged supply to market and doing it in an increasingly sustainable fashion looks to be a sound path to securing the futures for US ethylene-chain producers and their customers. Those opportunities and more will be on the negotiating tables over the next few days here in San Antonio.

Disclaimer: The views in this blogpost should in no shape or form be taken as actual forecasts and are my personal views only.