Major new opportunities are starting to appear in today’s New Normal world, as I describe in a new analysis for the Institution of Chemical Engineers. Please click here to read the full article.

We are set to enter a “New Normal” world as economies slowly reopen again with the arrival of Covid-19 vaccines. This will create great opportunities as business models go through fundamental change in a range of major industries, including energy, chemicals and pharma.

The reason for this transformation is that the pandemic has broken the inertia surrounding our work- and home-based routines. Travel, leisure, construction, real estate and other industries will likely never be the same again, as our priorities have shifted. And it is also clear that global supply chains have proved fragile and unfit for purpose, and so will have to be reshored:

- Critical elements such as containers have suddenly become like gold dust, with prices jumping more than four-fold to US$8,000 on key routes from China to Europe and the US.

- Texas’ failure to properly winterise its electricity grid has left companies around the world struggling to access the imports they need.

- The grounding of the EverGreen container ship in the Suez Canal created further disruption in many critical supply chains.

- Major industries such as autos are being forced to cut back production because of a shortage of the semiconductors, plastics and other key materials on which they depend.

This move to reshoring opens up one obvious opportunity, as it makes no sense to reshore on the basis of outdated technology.

Instead, companies have the opportunity to reduce costs and improve safety, quality and reliability by adopting digital, continuous and bio-enabled technology. As the UK’s health minister, Lord Bethell, noted in February with regard to the pharma industry (which has also struggled with major supply chain problems), the pandemic:

“Presents us with the perfect opportunity to build back greener. There is a lot that the medicines manufacturing industry should be doing, such as adopting technologies and approaches that lower the carbon footprint of the manufacturing supply chains.”

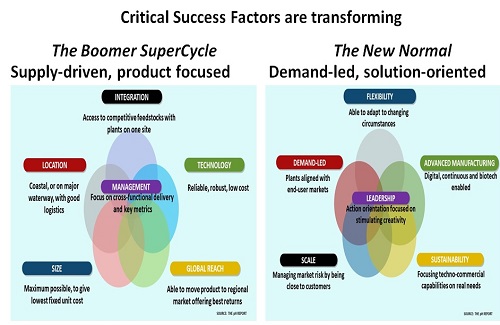

Critical Success Factors are therefore transforming, as the chart confirms:

- Flexibility is set to replace integration as companies adapt to changing market needs.

- Local supply, close to end-users will replace extended and unreliable global supply chains.

- World-scale plants will find it difficult to compete as the need to manage market risk increases.

- Advanced manufacturing based on being digital, continuous and biotech-enabled will replace legacy technologies.

- Sustainability rather than global reach will lead to major growth in demand for techno-commercial skills.

Change is often uncomfortable, but the good news is that these changes are very good news as the “build back better” programmes start to get underway. The energy, chemical and pharma industries will inevitably be in the frontline of these developments.

Underlying the transformation is the fact that sustainability is now replacing globalisation as the key driver for most industries. One reason for this is that increasing life expectancy means that the majority of population increase in most countries over the next decade will be in the over-55s. They are essentially a replacement economy – they already own most of what they need, and their incomes reduce as they move into retirement.

So companies are moving into a new world where being able to “do more with less” has become critically important for important segments of the population. We no longer need to globalise to access more “stuff” for an expanding younger population. Instead, we need to develop more sustainable and robust supply chains, based more on local needs and the principles of a circular economy.

Please click here to read the full article.