Polyethylene markets (PE) are moving into a crisis, with margins in NE Asia already negative, as I have been forecasting. Scenario planning is now a matter of potential life or death for companies likely to be impacted over the next 12-18 months.

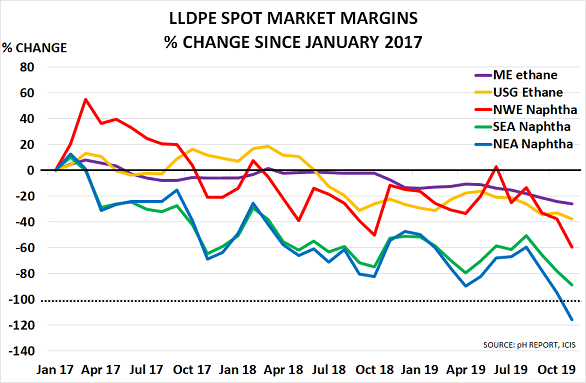

The collapse in margins is already quite dramatic as the chart based on ICIS data shows:

- NEA margins were $657/t in January 2017, and are now -$100/t; SE Asian margins have fallen from $909/t to $103/t

- NW Europe margins are down from $739/t to $300/t; US Gulf margins are down from $965/t to $603/t: Middle East margins are down from $1125/t to $833/t

The same pattern is also true for the other main grade, High Density PE (HDPE).

And, of course, today is only the start of the problems. As the second chart shows, there are vast amounts of new product coming online between 2019 – 2021 in both LLDPE and HDPE:

- LLDPE: China is adding 3.4 million tonnes; USA 1.8Mt; Russia and S Korea 800kt each; with India, Oman, Malaysia and Indonesia also adding capacity

- HDPE: China is adding 4.4Mt; USA 1.9Mt, S Korea 900kt, Russia 700kt; with India, Oman, Malaysia, Indonesia, Philippines, Iran and Azerbaijan also adding

The problem is that the fundamental assumptions behind the shale gas investments were simply wrong:

- Oil was most unlikely to always be >$100/bbl, providing a feedstock advantage with shale gas

- China wasn’t likely to be growing at double-digit rates, and always importing more petchems

- Globalisation was already ending, meaning that plants couldn’t be sited half-way across the world from their market

- Plastics will not always be the material of choice for single-use packaging applications

Essentially what happened is that companies stopped planning for themselves and allowed Wall Street to set their strategy, as one CEO told me:

“You may be right, but every time I mention shale on an earnings call, the share price goes up $5.”

It is now too late to wind back the clock. The US product from the integrated players has to go somewhere as their ethane feedstock is essentially a distressed product. If they don’t use the ethane to make ethylene and its derivatives, they cannot produce the shale gas.

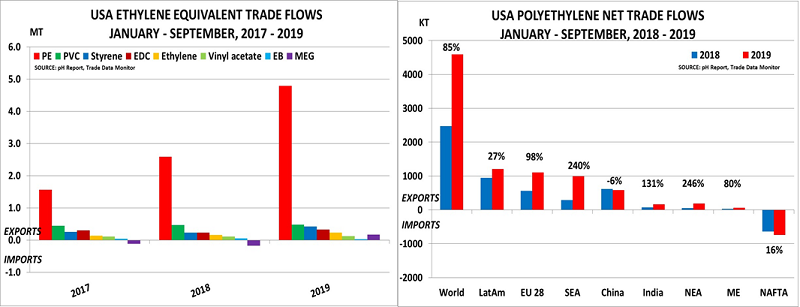

The result is shown in the charts above, based on data from Trade Data Monitor

- 2019 has seen vast amounts of new US ethylene-based exports, and more is still to come

- Most of it was exported as PE, where exports have risen 85% so far this year versus 2018

- The trade war means exports to China have actually dropped, so Europe, SEA and NEA have suffered major disruption

- US PE exports to these regions were up 98%, 240% and 246% respectively, causing margins to start their collapse

The world is therefore starting to divide into Winners and Losers, as the chart suggests. Non-integrated ethylene producers around the world are particularly at risk:

- They have to buy their feedstock at market prices, and they will have to sell into an increasingly over-supplied market

- As a result, it is quite likely that their margins will become negative – as they have done before in periods of over-supply

- At this point, integrated producers have the advantage as they are still making money upstream on oil/gas/refining

But there are also wider risks for European and Asian consumers down all the major value chains, as they will be impacted by lower cracker rates.

Scenario analysis must now be a top priority for potential Loser companies. There really is very little time left, as the margins chart confirms.