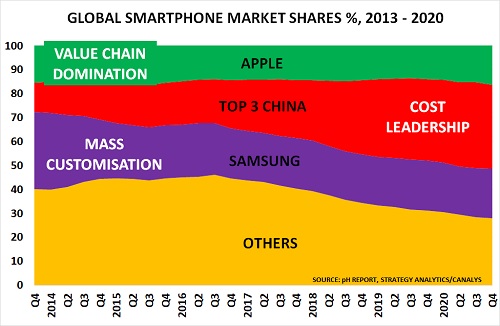

Smartphone markets continue to provide early warning of the major changes taking place in consumer markets. And Q4 data confirms the old rules are becoming less and less relevant:

- As the chart shows, market positioning is now all-important. Apple are stretching their lead in the ‘sweet spot’ of the value chain – design – and showed record profits in Q4 as a result

- They shipped an all-time record number of phones at 86m, very close to Samsung’s record quarterly volume back in 2013 – when it was the undisputed market leader with 30%+ share

- Samsung’s mid-market positioning continues to be squeezed between Apple and the Chinese cost leaders, and its share is likely to dip below 20% in 2021 – highlighting the squeeze it is facing

- Q4 also saw geo-politics impact the market, with US sanctions on Huawei leading its share to drop below 10% for the first time since 2015, when it was still entering the market

- Plus Q4 saw annual volumes stabilise at 1.3bn, down 19% versus 2017’s peak, confirming the shifts underway in demand patterns as people focus more value-for-money and home-life

The result is that Apple continues to capture most of the profits in the value chain, even though it doesn’t manufacture any part of the iPhone itself. It takes 2/3rds of total profit, based on 1/3rd of global revenue. Samsung, the market leader, takes just 17%.

As noted here in the past, Apple is also continuing to develop more service-based offerings, which will further insulate it from margin pressure. Offerings such as iCloud, Apple Music are being sold in the same way as iPods and the Apple Watch, based on the service they provide, and the user-experience – instead of just the function.

Apple’s other new strategy is to keep older models in the market for longer, whilst reducing their price as newer models enter the market:

- In the past, they phased out older models when new ones were launched and kept prices high

- The idea was to prevent ‘cannibalisation’ and stop buyers opting for older models because they were cheaper

- Apple have finally realised this was a mistake, as it left the cheaper end of the market to others

Apple aficionados will always want the latest version. But now, buyers who don’t care about having “the latest model” can buy an Apple product at a more reasonable price. This, of course, boosts Apple’s Gross Margins still higher, as they can spread their fixed costs over a larger number of phones.

The second chart highlights another key issue – the growing regionalisation of the market.

The USA was the premium market at $471. China and Europe were at $310 and $291, with some buyers opting for cheaper phones. Asia was at $243, with more buyers opting for the cheaper phones. Latin America and Middle East/Africa were cheapest at $166 and $164, with most buyers opting for cheapness:

- This meant China was the largest market in 2020 at $114bn – with 368m phones sold

- Asia-Pacific was worth $105bn – with 433m sold , whilst N America was worth $64bn with 136m sold

- Europe was worth $49bn, with 168m; Latin America was $19bn with 116m sold; MENA was only $12bn, with 71m sold

Market segmentation of this type went out of fashion in the SuperCycle, when buyers would happily max out on their credit cards to keep up with their friends. But it is now key for the future, as buyers become more choosy over how they spend their hard-earned cash.

Business is more complex as we move into the New Normal, and companies refocus on being demand-led, rather than supply-driven. This will be very good news for techno-commercial people, who can help them make the necessary trade-offs between consumer benefit and price.