“Its only when the tide goes out that you learn who’s been swimming naked.” We may soon discover the meaning of this wisdom from Warren Buffett, one of the world’s leading investors.

The reason is that the macro trends that have driven growth in the global chemical sector are now turning. For the past five years, central banks and governments have provided a tidal wave of credit and stimulus to support world markets. It has been worth $33 trillion, nearly half the size of today’s global economy, according to Bank of America Merrill Lynch.

But now, this tide is beginning to ebb. The economy thus seems close to a major tipping point, with interest rates already rising sharply in many countries. This is starting to expose those areas that have been swimming naked during the liquidity bubble.

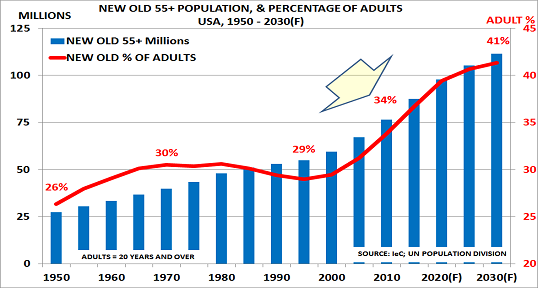

The key area that has been hidden relates to the ageing of the global population. As the chart shows, 34% of the US adult population are now in the low-spending, low-income New Old 55+ generation. And their numbers are set to rise sharply in future years.

They have already grown rapidly from 59m to 87m today. By 2030 they will have nearly doubled to 111m, and be 41% of the adult population. Household consumption is 71% of US GDP, so this has major implications for GDP.

The key question is ‘what are the key risks now that the liquidity bubble is ending’? The blog explores these in its latest analysis for ICIS Chemical Business. Please click here if you would like to download a free copy of the article.