Consumer sentiment is already at all-time lows. Rising energy, transport and food prices will likely soon push inflation above 10%, and interest/mortgage rates to 5%+, adding to the risk of a major and long-lasting downturn.

Chemicals and the Economy

Renewable electricity growth accelerates, as expansions account for 95% of global power increases through 2026

A new report from the International Energy Agency confirms that electricity is set to be the fuel of the future, powered by renewable sources. And the new German government’s decision to allocate 2% of Germany’s landmass to windfarms confirms the scale of the changes underway. The IEA’s chart above details the expansions now planned on […]

OPEC+ faces difficult decisions as Covid returns, recession risks rise, and oil prices crash

OPEC+ oil producers saw prices tumble $10/bbl (13%) on Friday as the world woke up to the fact that the next phase of the pandemic may be underway. And this is not the only challenge that they face. OIL PRICES HAVE ONLY BEEN HELD UP BY MAJOR SUPPLY CUTBACKS The first is the challenge from […]

Oil markets enter the endgame as car companies rush to electrify

Almost every day now sees a car company rushing to announce its plans to boost Electric Vehicle (EV) output. And key OPEC members – such as the UAE – are starting to recognise they have only a few years left to sell their oil, before the market disappears. Last May, the influential International Energy Agency […]

Friends of the Earth v Royal Dutch Shell – what did the Dutch Court rule, and what does it mean for Shell’s business?

My Dutch colleague, Daniël de Blocq van Scheltinga, is a graduate of Leiden University in the Netherlands, with a Master of Law degree and a specialty in International law. Here he gives his expert view on the Dutch court’s decision to order Shell to reduce its CO2 emissions by at least 45% , relative to […]

Oil markets, OPEC, enter the endgame for the Age of Oil

2 major events shocked oil markets last week. They marked the start of (a) the endgame for the Age of Oil and (b) the paradigm shift to the Circular Economy and the new Age of Energy Abundance. The new ‘Net Zero by 2050’ report from the International Energy Agency (IEA) was the first shock: It […]

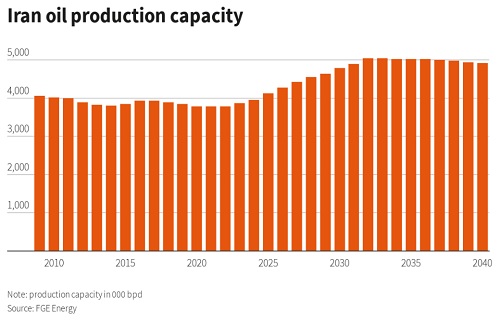

Iran highlights OPEC’s dilemma on output cuts

Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

Oil prices start to reconnect with coal and gas

Oil prices are finally starting to reconnect with other fossil fuel prices, as the chart shows. It compares US WTI prices in terms of $/MMBtu value (WTI/5.8), versus US natural gas and coal prices: In January 1990, WTI was $3.94 versus natgas at $2.30 and coal at $1.45 (all $/MMBtu) In January 2000, WTI was […]

Oil markets hit perfect storm as coronavirus cuts demand

Former Saudi Oil Minister Sheikh Yamani’s warning in 2000 looks increasingly prophetic today: “30 years from now, there will be a huge amount of oil – and no buyers. 30 years from now, there is no problem with oil. The Stone Age did not end because the world ran out of stones, and the Oil […]

Oil markets hold their ‘flag shape’ for the moment, as recession risks mount

Oil markets can’t quite make up their mind as to what they want to do, as the chart confirms. The are trapped in a major ‘flag shape’. Every time they want to move sharply lower, the bulls jump in to buy on hopes of a major US-China trade deal and a strong economy. But when […]