Major new opportunities are starting to appear in today’s New Normal world, as I describe in a new analysis for the Institution of Chemical Engineers. Please click here to read the full article. We are set to enter a “New Normal” world as economies slowly reopen again with the arrival of Covid-19 vaccines. This will […]

Chemicals and the Economy

Weak demand – and the illusion of a return to “normal”

My new interview with Real Vision focuses on the major changes underway in the economy. Our analysis of the chemical industry, auto market, and technology sector, suggests a return to the “old normal” is highly unlikely. Instead, major changes are underway in Demand Patterns, Reshoring, Energy Abundance, the Circular Economy and in Advanced Manufacturing. For […]

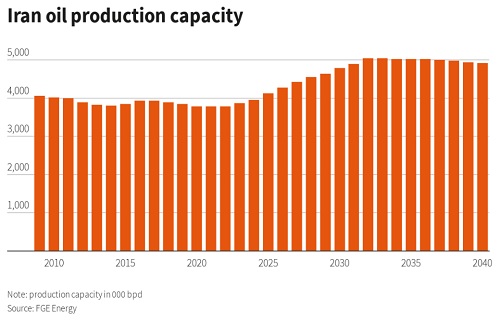

Iran highlights OPEC’s dilemma on output cuts

Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

5 key questions for success in the New Normal

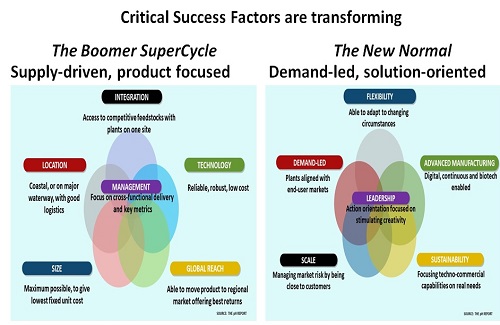

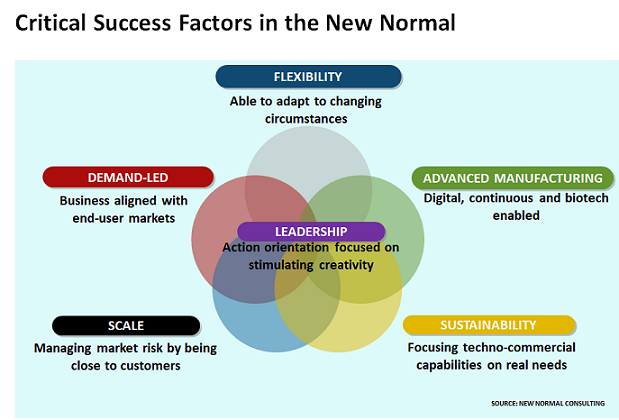

Sustainability rather than globalisation is becoming the key driver for business. And the paradigm shift this creates means that companies need to adopt new Critical Success Factors as shown above. Leadership skills will be essential at all levels of the organisation in order to stimulate the creativity and action orientation required for success. There are […]

Look for Winners and Losers in 2021

“There are decades where nothing happens; and there are weeks where decades happen”. Lenin’s famous insight was highly relevant to 2020. It was full of such weeks as the coronavirus pandemic became a catalyst for major paradigm shifts in the economy. Of course, some sceptics still expect a quick V-shaped return to ‘business as usual’, […]

OPEC set to lose out as Biden, EU and China focus on Climate Change opportunities

OPEC used to dominate global oil markets. In the early 1980s, there was even talk of another OPEC cartel to control gas prices. But those days are long gone. Instead OPEC members such as the UAE are increasingly aware they have only a limited time left to monetise their vast reserves of fossil fuels. This is […]

Oil prices signal potential end to the V-shaped recovery myth

Oil prices have moved into another ‘flag shape’ – which previously provided critical warning of the March collapse, and of those in 2014 and 2008. The shape is important as it means the bulls and bears have been battling each other to exhaustion, making it likely one or the other will give up. This time, […]

Bankruptcies now the key risk as hopes for V-shaped recovery disappear

Governments, financial markets and central banks all originally assumed the Covid-19 pandemic would be over in a few days or weeks. But it is now clear they were wrong. And unfortunately, there is little sign of a Plan B emerging. The idea was that consumers would have plenty of money in their pockets after the […]

The Top 5 pandemic paradigm shifts

The Covid-19 pandemic has accelerated the fundamental changes which were already underway in global markets, as I discuss in a new interview with Will Beacham of I.C.I.S. Companies and investors need to focus on the challenges and opportunities created by 5 major paradigm shifts as we move into the New Normal. These will impact individual […]

Oil prices start to reconnect with coal and gas

Oil prices are finally starting to reconnect with other fossil fuel prices, as the chart shows. It compares US WTI prices in terms of $/MMBtu value (WTI/5.8), versus US natural gas and coal prices: In January 1990, WTI was $3.94 versus natgas at $2.30 and coal at $1.45 (all $/MMBtu) In January 2000, WTI was […]