Beijing has a population of 21.5 million, but you wouldn’t know it from this BBC video from last Thursday. Normally busy streets and transport systems are eerily empty, with food deliveries often the main traffic on the roads. It’s the same picture in industry, with the Baidu Migration Index reporting only 26% of migrant workers […]

Chemicals and the Economy

Polyethylene’s crisis will create Winners and Losers

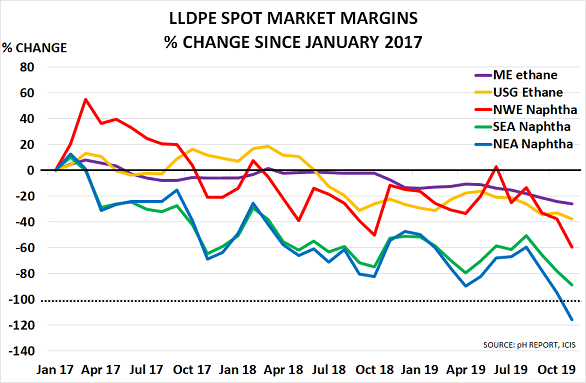

Polyethylene markets (PE) are moving into a crisis, with margins in NE Asia already negative, as I have been forecasting. Scenario planning is now a matter of potential life or death for companies likely to be impacted over the next 12-18 months. The collapse in margins is already quite dramatic as the chart based on […]

Oil markets hold their ‘flag shape’ for the moment, as recession risks mount

Oil markets can’t quite make up their mind as to what they want to do, as the chart confirms. The are trapped in a major ‘flag shape’. Every time they want to move sharply lower, the bulls jump in to buy on hopes of a major US-China trade deal and a strong economy. But when […]

Oil market weakness suggests recession now more likely than Middle East war

Oil markets remain poised between fear of recession and fear of a US attack on Iran. But gradually it seems that fears about a war are reducing, whilst President Trump’s decision to ramp up the trade war with China makes recession far more likely. The chart of Brent prices captures the current uncertainties: It shows […]

Recession risk rises as Iran tensions and US-China trade war build

Oil markets are once again uneasily balanced between two completely different outcomes – and one again involves Iran. Back in the summer of 2008, markets were dominated by the potential for an Israeli attack on Iranian nuclear facilities, as I summarised at the time: “Nothing is certain in life, except death and taxes. But it […]

Déjà vu all over again for oil markets as recession risks rise

Back in 2015, veteran Saudi Oil Minister Ali Naimi was very clear about Saudi’s need to adopt a market share-based pricing policy: “Saudi Arabia cut output in 1980s to support prices. I was responsible for production at Aramco at that time, and I saw how prices fell, so we lost on output and on prices […]

CEOs need new business models amid downturn

Many indicators are now pointing towards a global downturn in the economy, along with paradigm shifts in demand patterns. CEOs need to urgently build resilient business models to survive and prosper in this New Normal world, as I discuss in my 2019 Outlook and video interview with ICIS. Global recession is the obvious risk as we start […]

Asian downturn worsens, bringing global recession nearer

The chemical industry is the best leading indicator for the global economy. And my visit to Singapore last week confirmed that the downturn underway in the Asian market creates major risks for developed and emerging economies alike. The problem is focused on China’s likely move into recession, now its stimulus policies are finally being unwound. […]

Chemical output signals trouble for global economy

A petrochemical plant on the outskirts of Shanghai. Chinese chemical industry production has been negative on a year-to-date basis since February Falling output in China and slowing growth globally suggest difficult years ahead, as I describe in my latest post for the Financial Times, published on the BeyondBrics blog Chemicals are the best leading indicator for the […]

Oil prices flag recession risk as Iranian geopolitical tensions rise

Today, we have “lies, fake news and statistics” rather than the old phrase “lies, damned lies and statistics”. But the general principle is still the same. Cynical players simply focus on the numbers that promote their argument, and ignore or challenge everything else. The easiest way for them to manipulate the statistics is to ignore […]