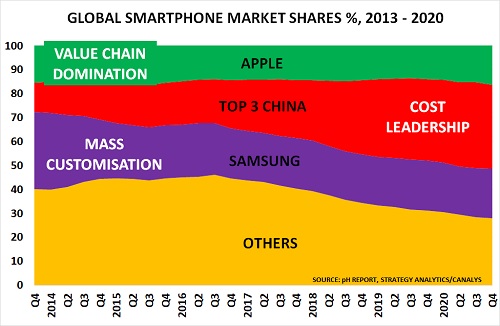

Smartphone markets continue to provide early warning of the major changes taking place in consumer markets. And Q4 data confirms the old rules are becoming less and less relevant: As the chart shows, market positioning is now all-important. Apple are stretching their lead in the ‘sweet spot’ of the value chain – design – and […]

Chemicals and the Economy

5 key questions for success in the New Normal

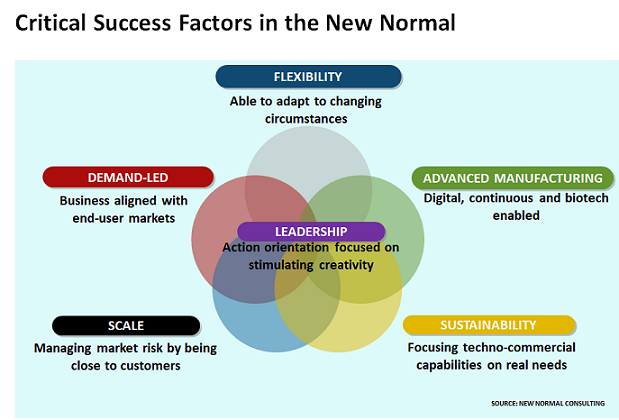

Sustainability rather than globalisation is becoming the key driver for business. And the paradigm shift this creates means that companies need to adopt new Critical Success Factors as shown above. Leadership skills will be essential at all levels of the organisation in order to stimulate the creativity and action orientation required for success. There are […]

OPEC set to lose out as Biden, EU and China focus on Climate Change opportunities

OPEC used to dominate global oil markets. In the early 1980s, there was even talk of another OPEC cartel to control gas prices. But those days are long gone. Instead OPEC members such as the UAE are increasingly aware they have only a limited time left to monetise their vast reserves of fossil fuels. This is […]

Welcome to the New Normal – a look ahead to 2030

10 years ago, I took a look ahead at what we could expect in the next decade, as discussed last week. Unfortunately, we now face the major economic and social crises that the chart predicted, if policymakers continued with ‘business as usual’. This week, I want to look ahead at what we can expect to […]

Oil prices signal potential end to the V-shaped recovery myth

Oil prices have moved into another ‘flag shape’ – which previously provided critical warning of the March collapse, and of those in 2014 and 2008. The shape is important as it means the bulls and bears have been battling each other to exhaustion, making it likely one or the other will give up. This time, […]

China’s property sector is at the epicentre of the crisis

A branch of Centaline Property Agency in Hong Kong © Bloomberg Indebted Chinese property developers threaten a domino effect on western credit markets , as I describe in my latest post for the Financial Times, published on the BeyondBrics blog Second-order impacts are starting to appear as a result of China’s lockdowns. These are having […]

“They may ring their bells now, before long they will be wringing their hands”

The wisdom of Sir Robert Walpole, the UK’s first premier, seems the only possible response to this weekend’s headline from the Wall Street Journal. How can a National Emergency ever be the basis for a major rise in stock markets? Of course, we all know that stock markets have become addicted to stimulus. But the […]

Chain’s smartphone and auto sales tumble as coronavirus hits demand

China is the world’s largest market for smartphones and autos – responsible for c30% of global sales for both. Yet as Reuters notes: “Most western policymakers and journalists view the world economy through a framework that is 10-15 years out of date, failing to account fully for the enormous shift in activity towards China and […]

China’s lockdown makes global debt crisis now almost certain

Beijing has a population of 21.5 million, but you wouldn’t know it from this BBC video from last Thursday. Normally busy streets and transport systems are eerily empty, with food deliveries often the main traffic on the roads. It’s the same picture in industry, with the Baidu Migration Index reporting only 26% of migrant workers […]

Coronavirus disruptions make global recession almost certain

Last month, our Hong Kong-based pH Report colleague, Daniël de Blocq van Scheltinga, warned of the “Possible development (epidemic?) of the Wuhan SARS like illness, and economic impact?” His current view of developments, and their likely impact, is as follows: Hubei, the epicentre of the corona virus epidemic, is a province in central China, where […]