My new interview with Real Vision focuses on the major changes underway in the economy. Our analysis of the chemical industry, auto market, and technology sector, suggests a return to the “old normal” is highly unlikely. Instead, major changes are underway in Demand Patterns, Reshoring, Energy Abundance, the Circular Economy and in Advanced Manufacturing. For […]

Chemicals and the Economy

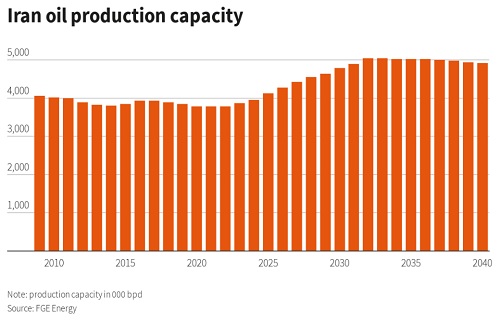

Iran highlights OPEC’s dilemma on output cuts

Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

Oil markets hit perfect storm as coronavirus cuts demand

Former Saudi Oil Minister Sheikh Yamani’s warning in 2000 looks increasingly prophetic today: “30 years from now, there will be a huge amount of oil – and no buyers. 30 years from now, there is no problem with oil. The Stone Age did not end because the world ran out of stones, and the Oil […]

Oil markets hold their ‘flag shape’ for the moment, as recession risks mount

Oil markets can’t quite make up their mind as to what they want to do, as the chart confirms. The are trapped in a major ‘flag shape’. Every time they want to move sharply lower, the bulls jump in to buy on hopes of a major US-China trade deal and a strong economy. But when […]

The End of “Business as Usual”

In my interview for Real Vision earlier this month, (where the world’s most successful investors share their thoughts on the markets and the biggest investment themes), I look at what data from the global chemical industry is telling us about the outlook for the global economy and suggest it could be set for a downturn. “We look at […]

Déjà vu all over again for oil markets as recession risks rise

Back in 2015, veteran Saudi Oil Minister Ali Naimi was very clear about Saudi’s need to adopt a market share-based pricing policy: “Saudi Arabia cut output in 1980s to support prices. I was responsible for production at Aramco at that time, and I saw how prices fell, so we lost on output and on prices […]

Plastics recycling paradigm shift will create Winners and Losers

My new analysis for iCIS Chemical Business highlights the paradigm shift now underway in the plastics industry. A paradigm shift is underway in the plastics industry as public concern mounts over the impact of plastic waste on the oceans and the environment. For 30 years, plastics producers have primarily focused upstream on securing cost-competitive feedstock supply. […]

Oil prices flag recession risk as Iranian geopolitical tensions rise

Today, we have “lies, fake news and statistics” rather than the old phrase “lies, damned lies and statistics”. But the general principle is still the same. Cynical players simply focus on the numbers that promote their argument, and ignore or challenge everything else. The easiest way for them to manipulate the statistics is to ignore […]

Chemicals flag rising risk of synchronised global slowdown

Chemicals are easily the best leading indicator for the global economy. And if the global economy was really in recovery mode, as policymakers believe, then the chemical industry would be the first to know – because of its early position in the value chain. Instead, it has a different message as the chart confirms: It […]

Economy faces slowdown as oil/commodity prices slide

Oil and commodity markets long ago lost contact with the real world of supply and demand. Instead, they have been dominated by financial speculation, fuelled by the vast amounts of liquidity pumped out by the central banks. The chart above from John Kemp at Reuters gives the speculative positioning in the oil complex as published […]