Whisper it not to your friends in financial markets, but the global economy is moving into recession. The US stock markets keep making new highs, thanks to the support from the major western central banks. But in the real world, where the rest of us live, the best leading indicator for the global economy is […]

Chemicals and the Economy

$50bn hole appears in New York financial markets – Fed is “looking into it”

Most people would quickly notice if $50 went missing from their purse or wallet. They would certainly notice if $50k suddenly disappeared from their bank account. But a fortnight ago, it took the New York Federal Reserve more than a day to notice that $50bn was missing from the money markets it was supposed to […]

Perennials set to defeat Fed’s attempt to maintain the stock market rally as deflation looms

Never let reality get in the way of a good theory. That’s been the policy of western central banks since the end of the BabyBoomer-led SuperCycle in 2000, when the oldest Boomer moved out of the Wealth Creator 25-54 age group and into the Perennial 55+ cohort. Inevitably this led to a slowdown in growth, […]

Uber’s $91bn IPO marks the top for today’s debt-fuelled stock markets

Uber’s IPO next month is set to effectively “ring the bell” at the top of the post-2008 equity bull market on Wall Street. True, it is now expecting to be valued at a “bargain” $91bn, rather than the $120bn originally forecast. But as the Financial Times has noted: “Founded in 2009, it has never made […]

Fed’s magic money tree hopes to overcome smartphone sales downturn and global recession risk

Last November, I wrote one of my “most-read posts”, titled Global smartphone recession confirms consumer downturn. The only strange thing was that most people read it several weeks later on 3 January, after Apple announced its China sales had fallen due to the economic downturn. Why did Apple and financial markets only then discover that smartphone sales […]

Stock markets risk Wile E. Coyote fall despite Powell’s rush to support the S&P 500

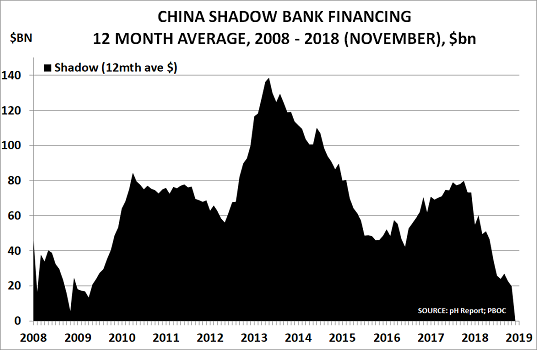

How can companies and investors avoid losing money as the global economy goes into a China-led recession? That’s the key question as we enter 2019. We have reached a fork in the road: Since 2008, Western central bankers have focused on supporting stock markets But the bursting of China’s shadow banking bubble means this cannot continue for […]

Chart of the Year – China’s shadow banking collapse means deflation may be round the corner

Last year it was Bitcoin, in 2016 it was the near-doubling in US 10-year interest rates, and in 2015 was the oil price fall. This year, once again, there is really only one candidate for ‘Chart of the Year’ – it has to be the collapse of China’s shadow banking bubble: It averaged around $20bn/month […]

The global economy and the US$ – an alternative view

Every New Year starts with optimism about the global economy. But as Stanley Fischer, then vice chair of the US Federal Reserve, noted back in August 2014: “Year after year we have had to explain from mid-year on why the global growth rate has been lower than predicted as little as two quarters back.” Will […]

Interest rates and London house prices begin return to reality

Global interest rates have fallen dramatically over the past 25 years, as the chart shows for government 10-year bonds: UK rates peaked at 9% in 1995 and are now down at 1%: US rates peaked at 8% and are now at 2% German rates peaked at 8% and are now down to 0%: […]

Baby boomers’ spending decline has hit demand and inflation

The Financial Times has kindly printed my letter below, wondering why the US Federal Reserve still fails to appreciate the impact of the ageing BabyBoomers on the economy Sir, It was surprising to read that the US Federal Reserve is still puzzled by today’s persistently low levels of inflation, given that the impact of the ageing […]