“What goes up, comes down” is usually a good motto when prices start to reach for the skies. As the great investor Bob Farrell noted in his 10 Rules, they usually go further than you think. But they don’t then correct by going sideways. The charts showing US lumber prices, China coal prices and the […]

Chemicals and the Economy

Oil markets, OPEC, enter the endgame for the Age of Oil

2 major events shocked oil markets last week. They marked the start of (a) the endgame for the Age of Oil and (b) the paradigm shift to the Circular Economy and the new Age of Energy Abundance. The new ‘Net Zero by 2050’ report from the International Energy Agency (IEA) was the first shock: It […]

Smartphone sales highlight new trends in consumer markets

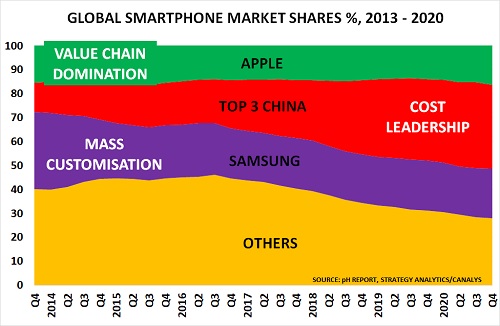

Smartphone markets continue to provide early warning of the major changes taking place in consumer markets. And Q4 data confirms the old rules are becoming less and less relevant: As the chart shows, market positioning is now all-important. Apple are stretching their lead in the ‘sweet spot’ of the value chain – design – and […]

G7 Summit shows leaders are forgetting the lesson of the 1930s

G7 Summits began in the crisis years of the mid-1970s, bringing Western leaders together to tackle the big issues of the day – oil price crises, the Cold War with the Soviet Union and many others. Then, as stability returned in the 1980s with the BabyBoomer-led economic SuperCycle, they became forward-looking. The agenda moved to […]

The global economy’s best leading indicator forecasts a downturn

If you want to know what is happening to the global economy, the chemical industry will provide the answers. It has an excellent correlation with IMF data, and also benefits from the fact it has no “political bias”. It simply tells us what is happening in real-time in the world’s 3rd largest industry. The chart […]

Q1 auto sales rise just 1.9% in world’s ‘Top 7’ markets

Its hard to be optimistic about the outlook for the global auto market. The chart above of the Top 7 markets, which account for around 2/3rds of global sales, highlights the growing uncertainty. It shows Q1 sales in 2015 (blue column) versus 2014 (blue). Overall, these were up just 1.9% at 15.8m. And although the […]

Volatility rises as central bank policies prove wishful thinking

Q1 was very difficult for many companies and investors. They had wanted to believe since 2009 that central banks could somehow control the global economy: The oil price would always be $100/bbl The US $ would always remain weak Central banks would always be able to stimulate growth in the economy Stock markets would always go up in the […]

Global stock markets still depend on low-cost money for support

The blog’s 6-monthly review of global stock markets highlights the narrow nature of the advance since September 2008, when the blog first began analysing developments. It shows their performance since the pre-Crisis peak for each market, and the performance of the US 30-year Treasury bond. Remarkably, only the US, India, Germany and the UK stock markets […]

India’s WTO veto marks end of global trade deals

The Cycle of Deflation has taken another lurch forward. The reason was India’s decision to veto last year’s Bali deal to streamline customs procedures. Almost certainly, this will prove the dying effort of the World Trade Organisation, which sponsored the proposal. The blog is particularly sad at this outcome. It has always believed that free […]

Global auto industry sales growth depends on China

Autos remain the world’s largest manufacturing industry, and the single biggest source of demand for chemicals and plastics. According to detailed analysis by the American Chemistry Council, each new US auto is worth $3,539 in terms of sales – and involves a wide range of products including antifreeze, plastic dashboards, bumpers and windows, as well as upholstery […]