This article was written by Vija Pakalkaite (EU Carbon and Power Analyst) and Matthew Jones (Senior Market Analyst) and it discusses the trend of multiple technology renewable energy support auctions which are taking place in Europe.

In recent years, the EU has seen an increasing move towards introducing competition between technologies into renewable auctions to help drive down support costs. Yet the push towards technology-neutrality continues to be countered by EU member states, which have often used specific auction rules to help manufacture a specific result. We believe that there will be no convergence across countries towards one size fits all technology-neutral auctions, as we write in our latest analysis for ICIS Power Perspective subscribers.

As a part of state aid decisions according to the 2014-2020 EU state aid guidelines, the European Commission has spearheaded a push for member states to distribute renewable electricity support (RES) via technology-neutral auctions. However, we believe that many member states will have both the incentive and the tools to give advantage to certain technologies to avoid one technology dominating renewable growth, although in order to comply with EU legislation many auctions will formally be multi-technology.

Proliferation of multi-technology auctions

In recent years there has been an increasing push from Brussels to keep costs at a minimum by introducing more competition to renewable auctions. Although such requirements were not laid out under the 2009 Renewable Energy Directive (RED), state aid guidelines determined that countries setting up new auction schemes from 2016 had to grant operational aid to all renewable generators on a non-discriminatory basis (technology-neutral) subject to exceptions. Subsequently, in RES support state aid cases after 2014 the commission either approved technology-specific auctions which had to be accompanied by at least one joint solar-wind tender (eg France, Germany and Greece) or where the new support systems formally were purely technology-neutral (eg Hungarian METAR, Estonian and Lithuanian schemes).

In order to assess how member states respond to this push, we dived into the ICIS Power Perspective RES auctions database and grouped all the auctions where more than one technology could compete for a budget as “multi-technology”. We did not distinguish between auctions where just onshore wind and solar were pitted against each other (France, Germany, Greece and Poland), auctions that were open to all technologies without discrimination (the Netherlands, Spain and Slovenia) or any other configurations (Denmark, Finland, the UK, and, again, Poland).

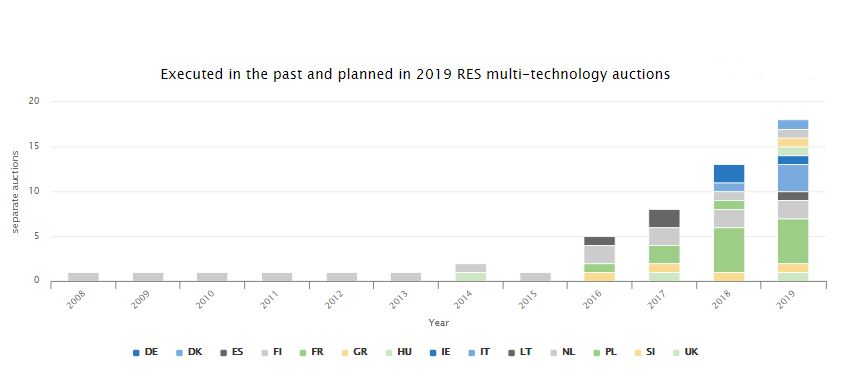

We observed that the number of auctions held in the EU that were open to more than one technology has risen from one in 2015 to 13 in 2018, spread across seven countries. If all planned auctions for 2019 are held on schedule, the number of multi-technology auctions will rise to 18, held across 11 countries, as shown in the chart below. The recently adopted recast Renewable Energy Directive (RED II), which will enter into force from 2021, contains similar wording to the state aid guidelines, which means that the trend towards increased competition in auctions is certain to endure.

Source: ICIS Power Perspective Renewable auctions database

Tweaking the rules

While the number of multi-technology RES auctions proliferated, the level of neutrality in these auctions is questionable as a high number of member states have used various types of intervention in the auction rules to help to manufacture a certain result. Below we outline the primary methods used:

Explicitly/implicitly excluding technologies from bidding

Size bands

Auction cap

Other specific rules

National logic vs European push

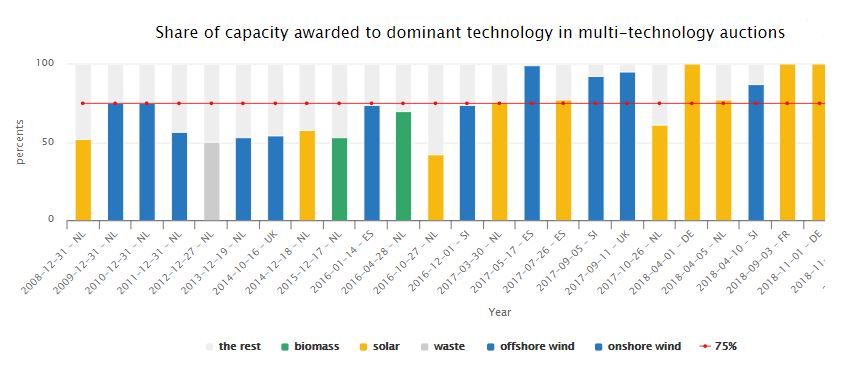

In some countries, there are also political reasons why one technology is not favoured. We see such reasons with onshore wind in Hungary and the UK, and until recently in Poland. Governments may also seek to protect state-owned energy companies.These motivations clash with the experience in multi-technology auctions held so far. As seen in the chart below, a single technology tended to dominate in awarded capacity.

Source: ICIS Power Perspective Renewable auctions database

In 13 of the past 27 auctions, one technology has been awarded 75% or more of the total awarded capacity. For eight of these auctions, the dominant technology was awarded more than 90% of the total capacity.

Outlook

Although in order to comply with EU legislation future auctions will be predominately multi-technology across the bloc, it will be up to the member states to have the final say as to their design. Governments possess a plethora of instruments to influence the outcome of RES auctions, such as preferences towards specific load hours or lead times, grid connection requirements, bid price ceilings or floors, size or capacity bands, or explicit exclusion of certain technologies from auctioning. For renewable project developers looking to bid into national auctions, it will be important to understand the specific rules for each auction to enable them to recognise which auctions are likely to provide the best opportunity to be awarded subsidy.

ICIS Power Horizon is a pan-European power price forecasting service that calculates power prices on an hourly basis taking into account regulatory and market developments. The mid- to long-term impact of these developments is analysed in detail in ICIS Power Perspective, a service alerting you to key market changes and providing full power market coverage of the EU 28.