Spot LNG prices over the past four weeks for January 2020 cargoes to Asia averaged $5.515/MMBtu, falling back 11% from average prices for December 2019 cargoes during the previous four weeks. The market remains oversupplied with LNG, with new US projects continuing to enter the market at the end of the year. So far there have been no major cold weather shocks in key importer regions in the northern hemisphere winter to act as a boost to demand.

The East Asia Index average for January supplies to China, Japan, South Korea and Taiwan was also down 42% from the previous year, again due to the general oversupply prevailing in the market this year.

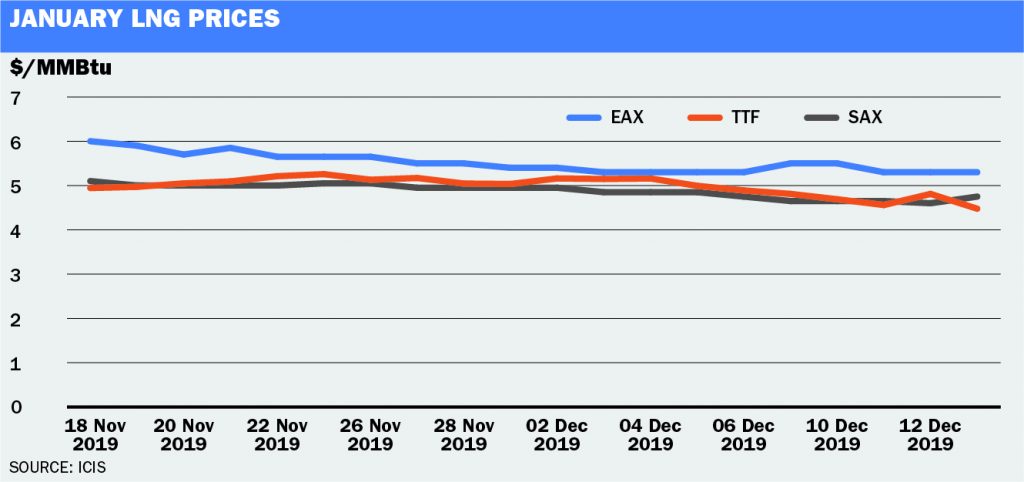

There were no large swings across the month, but spot prices drifted gradually lower, with the EAX falling from $6.00/MMBtu on 18 November to $5.30/MMBtu on 13 December, the last assessment day for January cargoes.

The Dutch TTF front-month, the benchmark contract for Europe, averaged $4.980/MMBtu across the four-week period, holding below the Asian market, but not at a wide enough discount to attract many cargoes from the Atlantic Basin to the Pacific. The South America Index averaged $4.880/MMBtu, although with the southern hemisphere now in summer, demand there is low.

New supplies enter

The 2.5 million tonnes per annum US Elba Island liquefaction project in Georgia loaded its first cargo in mid-December onto the 160,000cbm Maran Gas Lindos tanker. The plant, built around ten 0.25mtpa modules, was originally due to start operations in May 2019 but has suffered delays. The output is all contracted to major LNG trader Shell.

The US Freeport LNG plant in Texas, which has been building three 5.0mtpa trains for a total capacity of 15.0mtpa, loaded the first train one cargo in September 2019 and followed this up with the announcement of the first train two cargo in mid-December 2019. Freeport’s engineers McDermott said that they expected the first production of LNG from the third train in the first quarter of 2020.

Trinidad & Tobago’s Atlantic LNG plant has returned to full output in December after a maintenance outage of around 40 days that affected loadings in November. Australia’s Gorgon LNG plant completed a maintenance of around 50 days duration at the end of November.

US Henry Hub front-month gas prices have been trading around $2.30/MMBtu in recent days, giving a spread of around $3.00 between the US and European or Asian markets at present, sufficient to ensure continued production of LNG from US plants.

Europe’s storages remain full

Europe’s onshore gas storage facilities remain at high stock levels, around 90% full in mid-December, according to ICIS data, falling back slightly from a peak of around 98% at the start of the winter. Stocks this year remain above any of the previous five years, after storages entered winter at high levels, and draw-down has been relatively slow in the early weeks of winter.

Traders continue to question whether front-month prices could fall back substantially in the early months of next year if US production continues to grow and European storages remain at high levels. If front-month Dutch TTF prices fall back closer to US Henry Hub levels, that could start to encourage US LNG producers to turn down their output volumes to bring the market back into balance.

Traders also noted a backlog of ships, such as the BW Pavilion Aranda, waiting outside the UK port of Milford Haven in mid-December as bad weather and stormy seas delayed unloadings at the jetties for the South Hook and Dragon LNG regasification terminals.