Global LNG prices remained soft in the four weeks to mid-January as US export projects continued to progress, adding yet more capacity to an already oversupplied market.

The ICIS East Asia Index for February deliveries to Japan, South Korea, China and Taiwan averaged $5.295/MMBtu, falling 4% from the month before, and down 40% compared to the same period last year. The rate of new supply coming into the market over the last year from Russia, Australia and the US has outpaced the rate of growth in global demand.

The 2.5 million tonnes per annum US Elba Island project loaded its first cargo on 13 December onto the 160,000cbm Maran Gas Lindos, which delivered it to Pakistan on 3 January. Elba Island is a modular facility made up of ten 0.25mtpa trains, not all of which are yet active. The output is contracted to Shell.

The second 5.0mtpa train at the US Freeport LNG facility loaded its first cargo a few days later on 17 December, onto the 138,000cbm Bilbao Knutsen, which took it to the Rovigo terminal in Italy.

By the end of the month the operators of the US Cameron LNG facility said they had produced the first LNG from their second 4.5mtpa train, though not yet necessarily enough for a full cargo.

The second trains at Freeport and Cameron will build up capacity over the first quarter of 2020 and each plant will also bring on a third train later in the year, providing yet another boost to supply. Russia’s Yamal LNG, meanwhile, is expected to add a fourth train of 0.9mtpa capacity during early 2020.

Europe-Asia spread widens

The Dutch TTF price, the benchmark for European gas and LNG, averaged $4.202/MMBtu over the same period. The spread between the TTF and the EAX widened as the month went on, from as little as 70 cents in mid-December to $1.59/MMBtu by mid-January. The widening spread was even starting to re-awaken some talk about the possibility of reloading cargoes from Europe for sale into Asia.

The South America Index (SAX) averaged $4.031/MMBtu over the four weeks, moving fairly close in line with the Dutch TTF. South America is now in its summer, with more limited demand than during its winter.

Europe’s onshore gas storages are still at high levels for the time of year after a relatively mild start to winter. Front-month TTF prices of $3.69/MMBtu at mid-January offered limited profit for US exporters who have to buy Henry Hub gas at around $2.15/MMBtu, then pay for liquefaction, shipping and regasification costs out of the remaining $1.54/MMBtu spread.

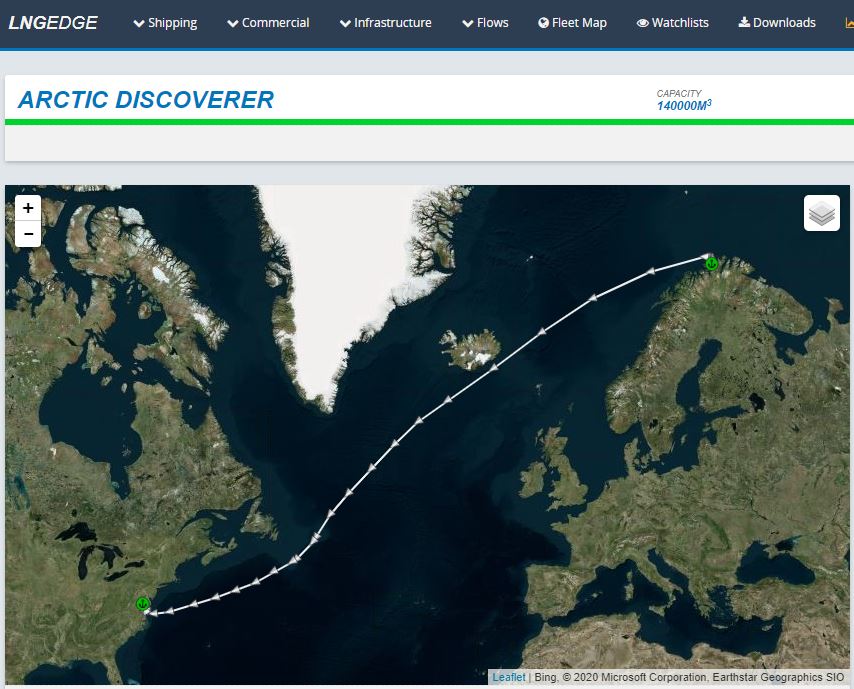

Above: The Arctic Discoverer delivers a Norwegian LNG cargo to Cove Point in the US in early January.

Some parts of the US were importing cargoes however, due to congested pipelines from the US Gulf production area to key consumption areas further north. The Cove Point facility in Maryland looks set for at least four cargo imports this winter, arriving from Nigeria, Trinidad and Norway. Everett at Boston is receiving regular Trinidad cargoes. Further north again, Canada’s Canaport facility is also taking in LNG from Trinidad.

Production outages

Algeria’s Skikda LNG plant shut down in mid-December for two months of maintenance work, although exporter Sonatrach said it could meet its obligations by loading cargoes from Arzew instead.

In Malaysia in mid-January, there was an explosion on the Sabah-Sarawak pipeline that delivers feedgas to the major Bintulu production facility. The impact was not immediately clear.

The Zeebrugge terminal in Belgium has opened a new fifth storage tank, allowing it to store Russian Yamal LNG cargoes, and then reload them onto other ships.

Thailand’s power company EGAT imported its first cargo of LNG to the country’s Map Ta Phut terminal on the 145,000cbm Seri Angkasa on 28 December, using third party terminal access rules for the first time.

Looking longer term, Nigeria’s NLNG just after Christmas announced its long-awaited final investment decision on a seventh production train that will take NLNG’s output up from 22mtpa to 30mtpa by 2024.

by Alex Froley