Chemical market overcapacity and weakening demand: a perfect storm

(2024 update)

Remodelling in the face of Chinese overcapacity

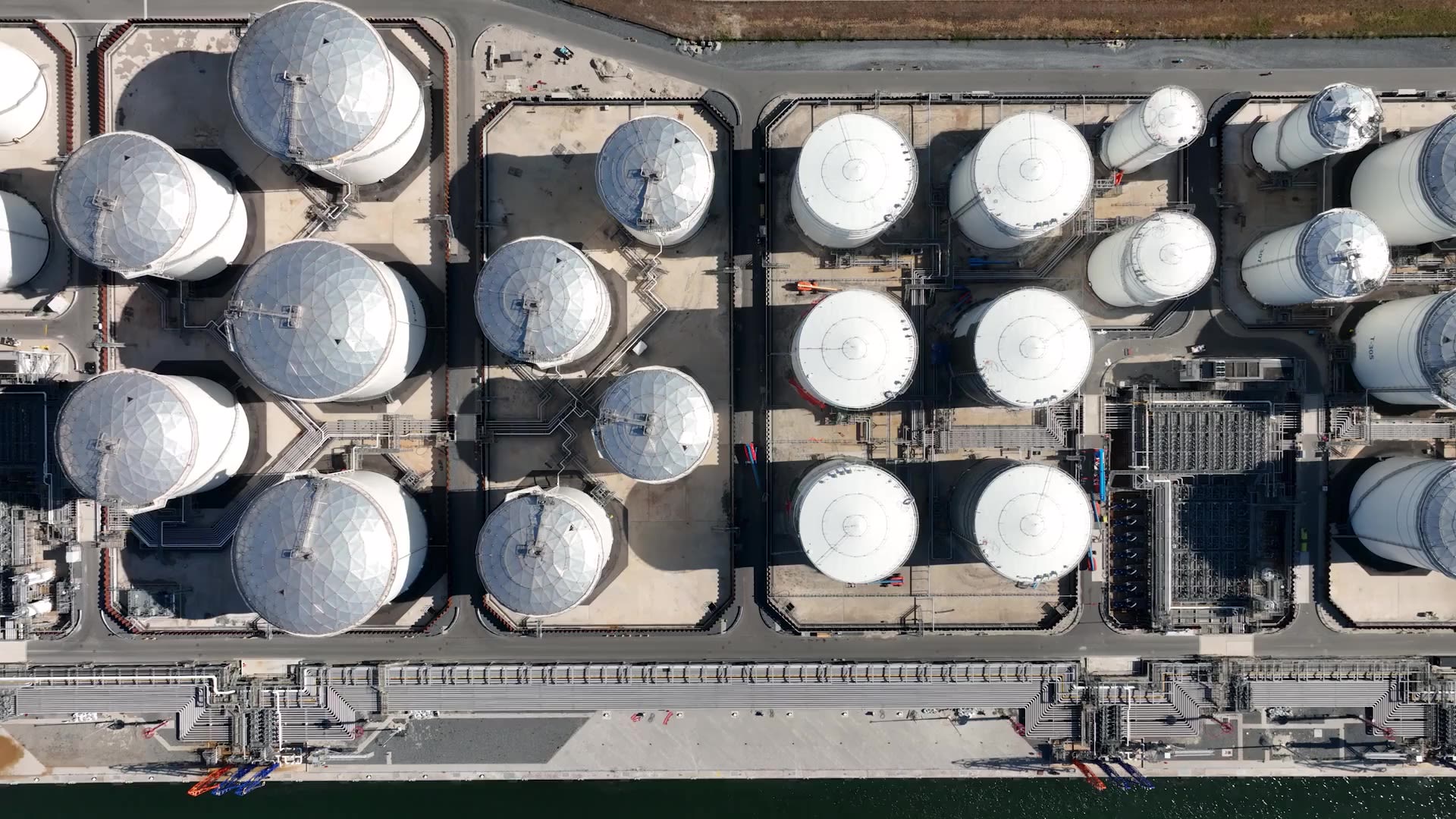

Following several years of significant investment in production capacity in China, a perfect storm is hitting the chemicals market, as increased global capacity meets weakening demand. The global oversupply of petrochemicals is expected to continue, with China forecast to add 18.7m tonnes/year of capacity in 2024 in the six chemicals-building blocks1, following record increases in 2022 and 2023.

Against the backdrop of a worsening macroeconomic outlook, chemical market participants are having to contend with an unprecedented level of uncertainty within the industry.

Short-and medium-term factors such as:

Plus longer-term, structural changes such as:

Businesses are being required to adapt, incorporating flexibility into operating models to maximise short-term opportunities, and remodelling to succeed in a drastically different trading landscape.

Weakening demand

Given its importance in the production of manufactured goods, the chemical industry was one of the first to react when high inflation, rising interest rates and record energy prices began to dampen consumer spending in 2022. Chemical manufacturers and producers responded by cutting inventories and operating capacity.

At the same time, a longer-term structural slowdown had begun in China in 2021. This was the result of the country’s real estate bubble bursting, its ageing population and increasing trade tensions with the West. The impact of this is significant because China still accounts for nearly half of global demand for chemicals and petrochemicals. In 2024, the country is forecast to consume almost as much polyethylene as the rest of the developing world combined, despite having a population less than 30% of its size: 1.4 billion vs 5.3 billion.

Following an end to the largest government stimulus package on record, and with weak export markets and a decreasing household-forming demographic, demand growth has begun to slow. Growth in Chinese consumption across most chemicals was in the low single digits or even negative in 2021-2023 despite widely being expected to be in the high single digits, and this has contributed to the current oversupply. This pattern looks set to continue in 2024.

Chinese overcapacity

In 2024, global overcapacity in the six chemical building blocks1 is forecast to reach 222m tonnes, the highest since ICIS Supply and Demand records began in 1978. This figure is expected to rise further to 226m tonnes in 2025.

Surplus chemicals capacity has been building in China since 2014, five years after the launch of a government programme to increase self-sufficiency in an industry perceived as high value. By 2030, China is forecast to account for 38% of global capacity in the six chemicals-building blocks1.

Chinese domination in certain key chemicals is increasing rapidly:

China’s forecast increase of 18.7m tonnes/year of chemical capacity in 2024 will account for 81% of the total global increase in capacity.

In 2024, China is forecast to account for 23% of global ethylene capacity, the core building block for over 75% of petrochemical products.

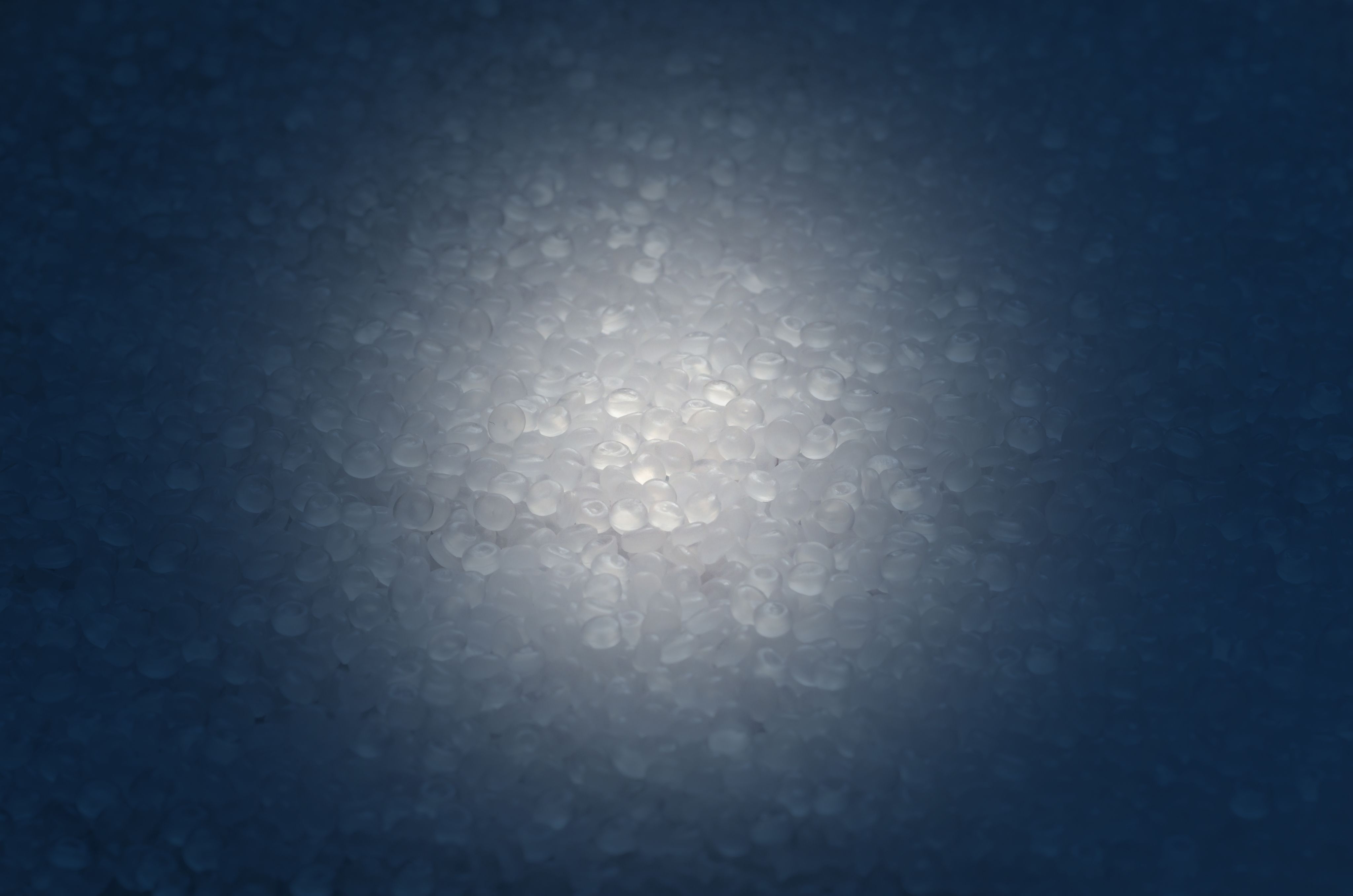

China is now the world’s biggest exporter of polyethylene terephthalate (PET) resins, purified terephthalate acid (PTA), polyvinyl chloride (PVC) and polyester fibres.

Chinese exports of polypropylene (PP) rose from around half a million tonnes in 2020 to 1.3m tonnes in 2023, while net imports more than halved from 6.1m tonnes to 2.8m tonnes.

Economies of scale have also led to China becoming a much larger producer in some fine and specialty chemicals such as plastics additives. Given the reliance of plastic compounds on additives for their manufacture, this development will significantly impact future supply chains and pricing.

European competitiveness

When energy prices hit record highs in Europe in 2022, the impact was a significant decrease in the competitiveness of European chemical producers. The US and Middle East have abundant natural-gas liquid feedstocks and the capability to produce the higher-grade products that European producers require. These countries have been successfully increasing exports of ethylene derivates, most notably to regions reliant on higher-cost oil and coal feedstocks.

While European customers remain committed to sourcing products locally in order to meet sustainability commitments, the cost may make this unfeasible.

Carbon reduction: the longer-term challenge

Chemicals and petrochemicals account for an estimated 920m tonnes of CO2 equivalent emissions each year, making these industries the third-largest industrial subsector in terms of direct CO2 emissions. The increasing imperative to report Scope 3 emissions and reduce carbon footprint is therefore of critical importance. Automation, new technologies and AI are reshaping production processes and facilitating the development of new biodegradable and recyclable materials, while enabling chemicals producers to reduce emissions.

As the circular economy takes shape, underpinned by increasingly stringent regulation, demand for lower resource-intensive products and recycled materials, as well as a move towards lower consumption and reuse, are reframing longer-term trends.

How to remodel for the longer term

The next decade will prove critical in the evolution of chemical supply chains as suppliers adapt to slower growth, further market consolidation, changing demand and increased competition from China, as well as greater use of technology and automation.

However, through the use of accurate and granular supply chain data, chemical market participants can get a clear picture of current and future plant-level operating capacity to remodel for the longer term with confidence.

Forecasts taken from ICIS Supply & Demand Database (ICIS S&DD). ICIS S&DD provides daily updates on supply, demand and trade flow data, plus monthly and quarterly round-ups, for over 100 commodities in 175 countries, as far ahead as 2050.

1 the six chemical building blocks: ethylene, propylene, butadiene, benzene, mixed xylenes and toluene

Author:

Corinne de Berry is a Senior Copywriter at ICIS, working across sustainability, chemicals and energy. Her interests span decarbonisation/net zero, recycling and the energy transition.

Related content

Speak with ICIS

If you are looking to learn how our market intelligence can help you better navigate complex commodity markets, get in touch with us today. Complete your details, submit the contact form and a member of the ICIS team will be in touch.