Europe benzene market struggles to see past gloom in H2 2023

With ample supply and thin demand for benzene in Europe in the coming months, the Q3 outlook is generally gloomy, but some participants maintain a positive view for 2024 when they expect macroeconomic headwinds to ease.

“We’re not headed for stellar recovery, but fingers crossed things won’t get worse,” a Europe-based benzene producer said, referring to the market outlook and noting that inflation and interest rates appeared to be stabilizing.

Another producer shared similar views on the cycle of interest rate hikes and impacts on sentiment: “If there is confidence that we’ve reached the top, that will create demand.”

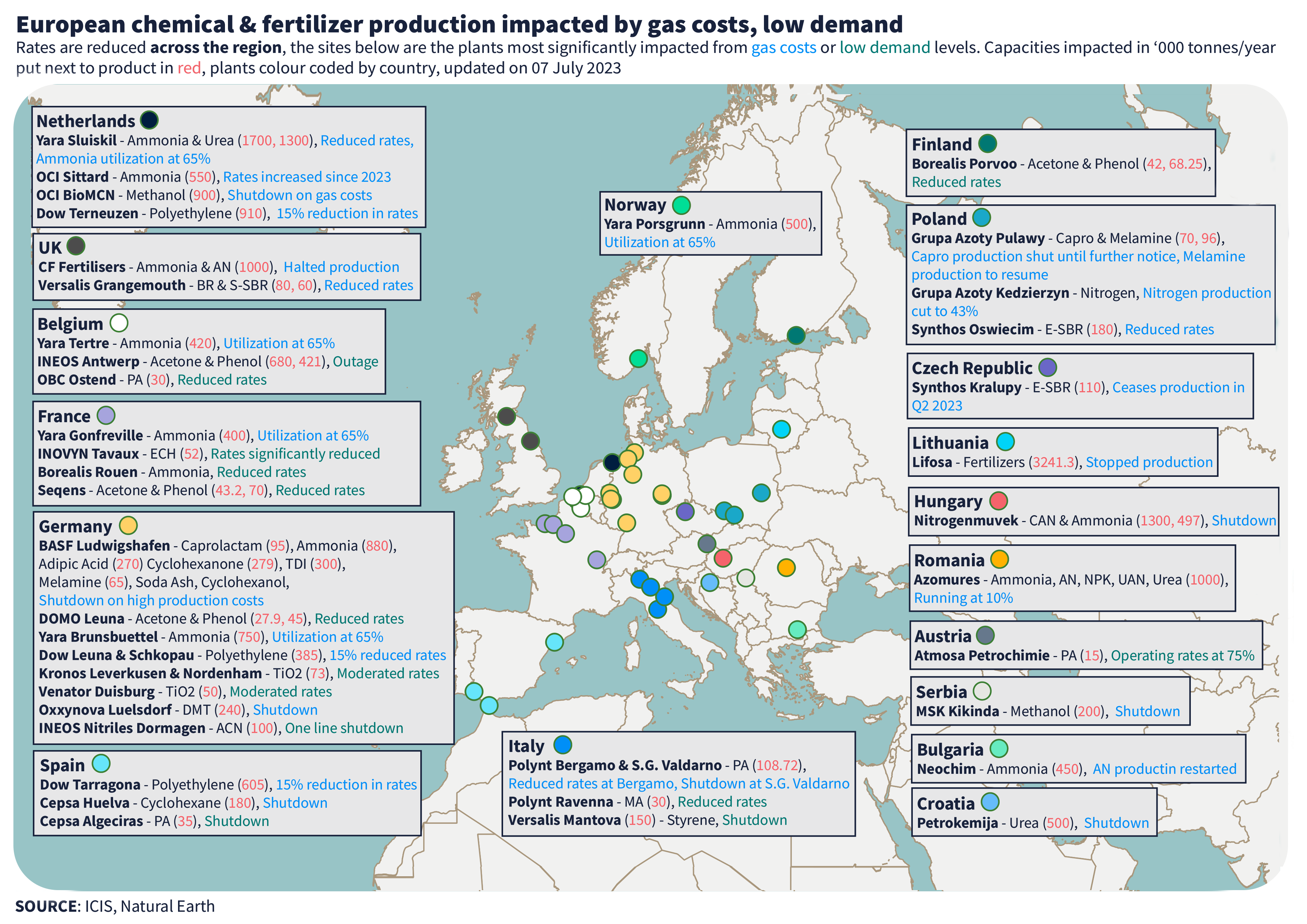

But participants also point to Europe’s structural cost disadvantage to other regions, as costs of natural gas, a key heating fuel in chemical production, have soared in Europe well above those in the US after the Russian invasion of Ukraine.

This has put pressure on the domestic chemicals industry as imports of benzene and derivatives become more competitive.

“Everyone is running reduced,” a second Europe-based benzene producer said referring to run rates at the region’s 10.6m tonnes/year of installed capacity.

Spreads between benzene and its main chemical outlet, styrene, were in negative territory several times this year, partly as a result of Europe's high benzene costs relative to other regions.

Others were less optimistic about the next quarter. “There’s no recovery in sight, [and there’s] imports we need to figure out how to deal with,” a European chemicals distributor said. “We’ve been growing year-on-year, but now the industries are getting destroyed.”

With a lack of consumer confidence, polymer demand would “get worse – a lot worse – before it gets better,” the distributor added.

Inflation coupled with deteriorating sentiment continue to stymie the construction industry, a major outlet for benzene derivatives, and global central banks are struggling to tame rising prices while not hindering economic growth.

There are concerns about short-term liquidity because many property developers are over-leveraged.

The S&P Global eurozone construction purchasing managers' index (PMI) fell to 44.6 in May from 45.2 in April, which means that the index has now spent more than a year below the expansionary 50.0 level. This weakness is expected to continue for most of 2023 as Germany faces a deteriorating economy, although the index forecast for 2024 is 54.20.

Benzene supply is expected to remain sufficient in Europe in the third quarter, as spreads over feedstocks remain close to or above breakeven, and as derivative consumption constraints are seen continuing.

Availability was generally ample in Q2, although volumes produced domestically are understood to have declined despite healthy spreads over feedstock naphtha.

Pygas output from crackers should remain constrained by current low operating rates and reduced use of naphtha on a seasonal basis.

It is also likely that pygas will remain in demand for gasoline blending which could also limit benzene production. Benzene supply may also be moderated as export arbitrage opportunities become available.

“Driving season is panning out but not the levels we saw last year,” the producer said. Benzene demand spiked in mid-2022, as octane-boosting components for gasoline were in short supply, partly as a result of sanctions on Russian oil products.

And despite a strong US driving season this year, shipments of cheaper benzene from South Korea to the US have surged in recent months, displacing European product and keeping the westbound arbitrage firmly closed.

Demand for European benzene is generally expected to remain poor in the coming months, due to reduced downstream operating rates, weak chemical consumption, and seasonal weakness during the summer holiday period.

“There’s only speculation, [and] nobody knows,” if demand will recover in 2023, another benzene producer said referring to the poor demand outlook. A couple of customers were “going well,” while others were locking in orders up to November in an effort to manage inventory, after the recent market length.

Benzene is used to produce a number of intermediates that are used to create polymers, solvents and detergents.

Author

Related content

Speak with ICIS

If you are interested in learning about how our specialist insight can help you make better business decisions, contact the ICIS team today. Simply complete the form and we will get in touch with you as soon as possible.